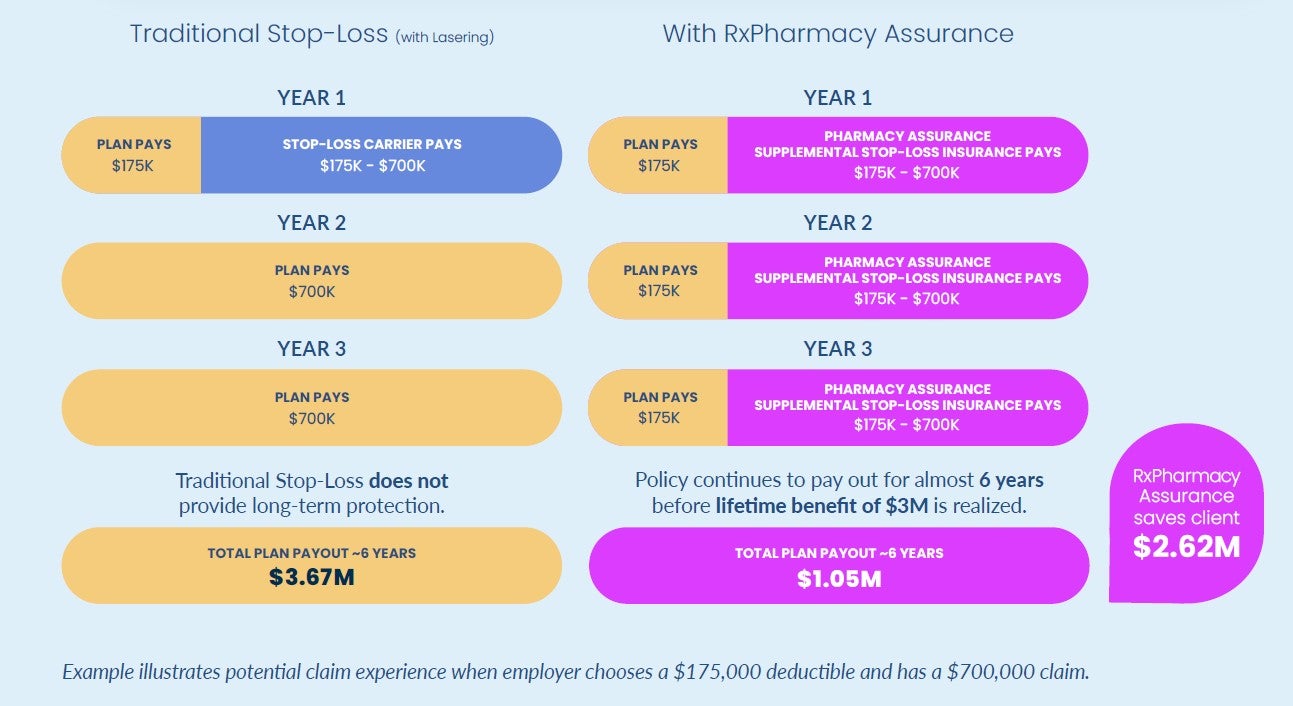

Just one high-cost specialty drug claim could significantly strain, or even break, a self-funded employer’s budget. Over 50% of RxBenefits® clients had a member with an annual claim over $100,000, and over 15% had an annual claim over $250,000.

Traditional stop-loss insurance covers high-cost medical events, like heart transplants, but fails to address ongoing expenses from chronic conditions like hemophilia. Specialty drug claims for these long-term

treatments are often excluded and expose your clients to increased costs and risk.

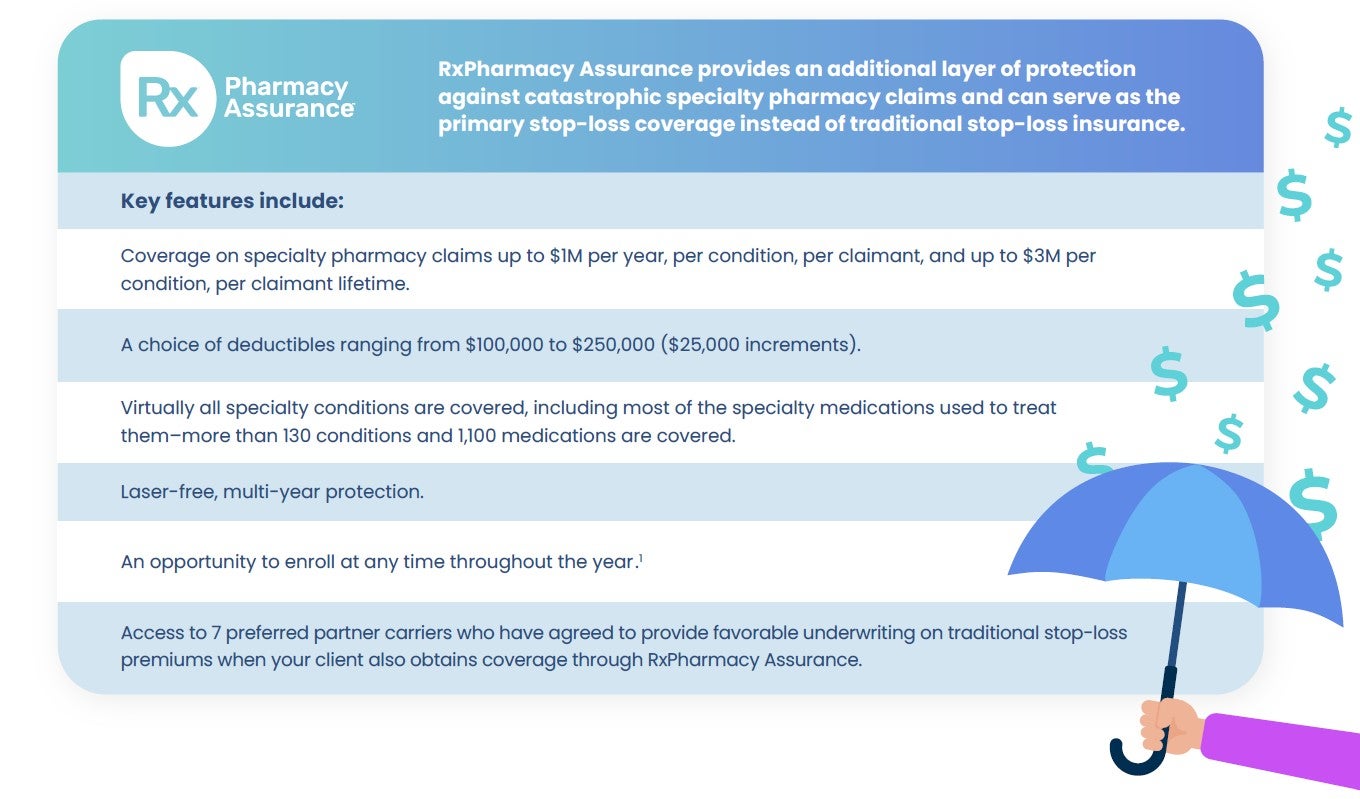

Now is the time to offer your clients peace of mind with our supplemental stop-loss protection that they can’t obtain anywhere else.

Email Kathleen Grasse at

kgrasse@rxbenefits.com to request

a quote and include the desired

deductibles (attachment points).

Review quote and choose deductible.

Fill out the Client Interest Form

to begin the contract process,

including Participant Agreement

and ACH banking information.

Don’t forget to contact our 7 preferred partner carriers to secure favorable pricing or contract terms for traditional stop-loss insurance.

1 Applications received by the 15th of the month can begin coverage on the first of the subsequent month.

Please refer to the RxPharmacy Assurance Supplemental Stop Loss Policy for additional requirements, terms and conditions.