How It Works

Coverage Examples

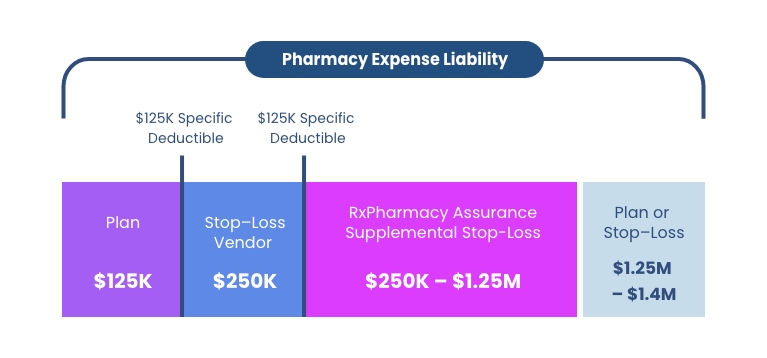

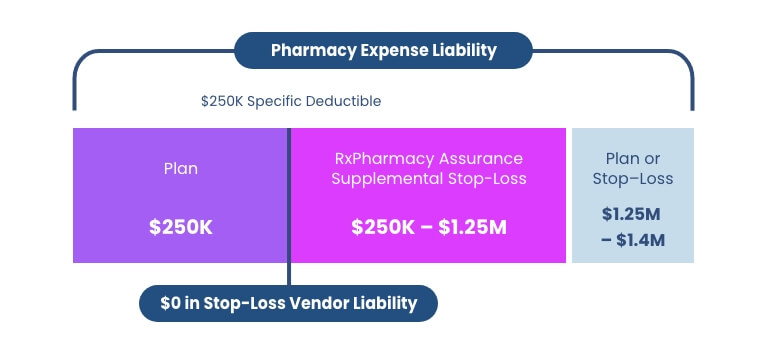

RxPharmacy Assurance’s stop-loss supplement is designed specifically for pharmacy risk associated with virtually all specialty conditions and most of the specialty drug therapies used to treat them – and provides multi-year protection that extends beyond traditional stop-loss coverage.

Once an eligible member reaches a plan cost equal to the plan’s deductible – for example, $250,000, the plan is entitled to reimbursement of qualified expenses up to the limits of the policy—$1,000,000 annually; $3,000,000 lifetime. Employers that remain continuously enrolled will continue to receive benefits in subsequent years for those members that are new to plan or newly diagnosed after the initial enrollment date, up to the limits of the policy.