With specialty pharmacy supplemental stop-loss coverage in place, the self-funded company avoided potentially catastrophic claim.

The Situation

New member needed high-cost specialty medication.

In 2022, a Southeast tech company saw the increasing cost and risk associated with specialty drugs and purchased supplemental stop-loss coverage for 1,800 employees and 3,400 members, including covered dependents. In 2023, a new hire – whose son had hemophilia – joined the team, and an $800K annual claim hit the plan.

The Solution

Comprehensive protection against catastrophic claims

In 2022, the tech firm had the foresight to mitigate the risks associated with large, unexpected, and potentially catastrophic pharmacy claims by obtaining coverage through RxPharmacy Assurance. The flexible, accessible specialty pharmacy supplemental stop-loss solution protects against risks associated with virtually all specialty conditions and most of the specialty drug therapies used to treat them. The company was able to successfully avert

the budget-breaking specialty claim associated with hemophilia thanks to this already in place coverage.

RxPharmacy Assurance is designed to provide long-term protection from costly specialty claims

The Impact*

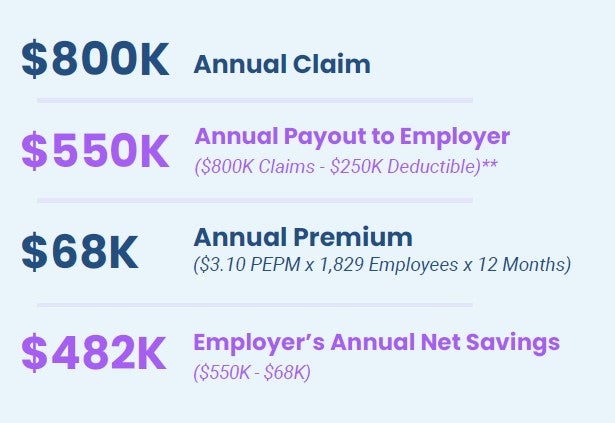

Once the new member’s claim hit the $250K deductible, the plan was eligible for reimbursement for qualified expenses. RxPharmacy Assurance delivered a $550K** payout with a $68K premium, a net savings of $482k. It will also help shield the client from potential future spikes in traditional stop-loss premiums. With supplemental stop-loss protection in place, the client is likely to be able to maintain more affordable coverage.

Long-term protection against unexpected potentially catastrophic specialty claims

RxPharmacy Assurance is a specialty pharmacy supplemental stop-loss solution. It goes above and beyond traditional stop-loss coverage, offering employers peace of mind by mitigating the risk associated with high-cost specialty drug claims and their potentially devastating impact on financial well-being.

*Based on 2023 claims and policy rate.

**Annual benefit: $1M in excess of deductible per year/condition/claimant. Lifetime benefit: $3M lifetime coverage, per condition and claimant.